Montage Gold Continues to Rapidly Advance Its Koné Project On-Budget and Well On-Schedule

Oxide circuit creates potential for earlier start-up • Owner mining with equipment finance • Further higher grade discoveries

HIGHLIGHTS:

- Well on-schedule for first gold pour in Q2-2027 and on-budget with more than $418m of capital committed, representing approximately half of the total upfront capital expenditure, with prices in-line with expectations

- Rapid construction progress achieved with notably six CIL tanks already erected, mill foundations completed, water supply infrastructure completed, and resettlement approaching completion

- Oxide circuit construction underway to provide increased operational flexibility and potential to advance first gold pour

- Shift to owner-mining operating model expected to provide greater operational flexibility while enhancing efficiencies

-

Well on track to achieve the previously published short-term objective of discovering more than 1Moz of M&I resources at a 50% higher grade compared to the Koné deposit, with further resource updates expected in Q4-2025

ABIDJAN, Côte d'Ivoire, Oct. 06, 2025 (GLOBE NEWSWIRE) -- Montage Gold Corp. (“Montage” or the “Company”) (TSX: MAU, OTCQX: MAUTF) is pleased to announce that rapid construction progress continues to be made at the Company’s flagship Koné project in Côte d’Ivoire, which remains on-budget and well on-schedule for first gold pour in Q2-2027.

A total of 4.5 million construction hours have been worked since the commencement of the project with key milestones achieved including the erection of six CIL tanks, completion of mill foundations and water supply infrastructure, while the resettlement is nearly complete. These milestones were achieved approximately two months ahead of schedule, with the next key milestone being the delivery of the ball mill on-site in Q1-2026. A total of approximately $418.3 million of capital has been committed to date, representing approximately half of the total upfront capital expenditure, with prices in line with expectations.

In addition, several initiatives are currently underway to further unlock value at the Koné project, aimed at enhancing the production profile from the onset, whilst providing strategic and operational flexibility over the life-of-mine, as detailed below:

-

Integration of higher-grade material from the onset of production:

- Recent discovery of higher-grade satellites positions the Company to achieve its previously published short-term objective of discovering over 1Moz of M&I resources at a 50% higher grade compared to the Koné deposit1 with the goal of integrating new discoveries from the onset of production. Indicated Resources for satellite deposits have already grown by 404koz to 924koz at 1.32 g/t Au, with an additional 140koz at 1.09 g/t Au of Inferred Resources, while further resource updates are expected in the coming months given the 120,000 meter drill programme currently underway for 2025.

- Identification of high-grade zones within the Koné and Gbongogo Main deposits following the completion of 56,000 meters of pre-production grade control drilling conducted in 2025, with full results on track for publication later this year.

-

Strategic operational flexibility with improved efficiency:

- Process plant design enhancements following the implementation of several key design changes compared to the Updated Feasibility Study (“UFS”) published in January 2024, intended to enhance the crushing and milling circuit and improve the efficiency of the overall operation, as detailed in the Company’s press release dated December 18, 2024.

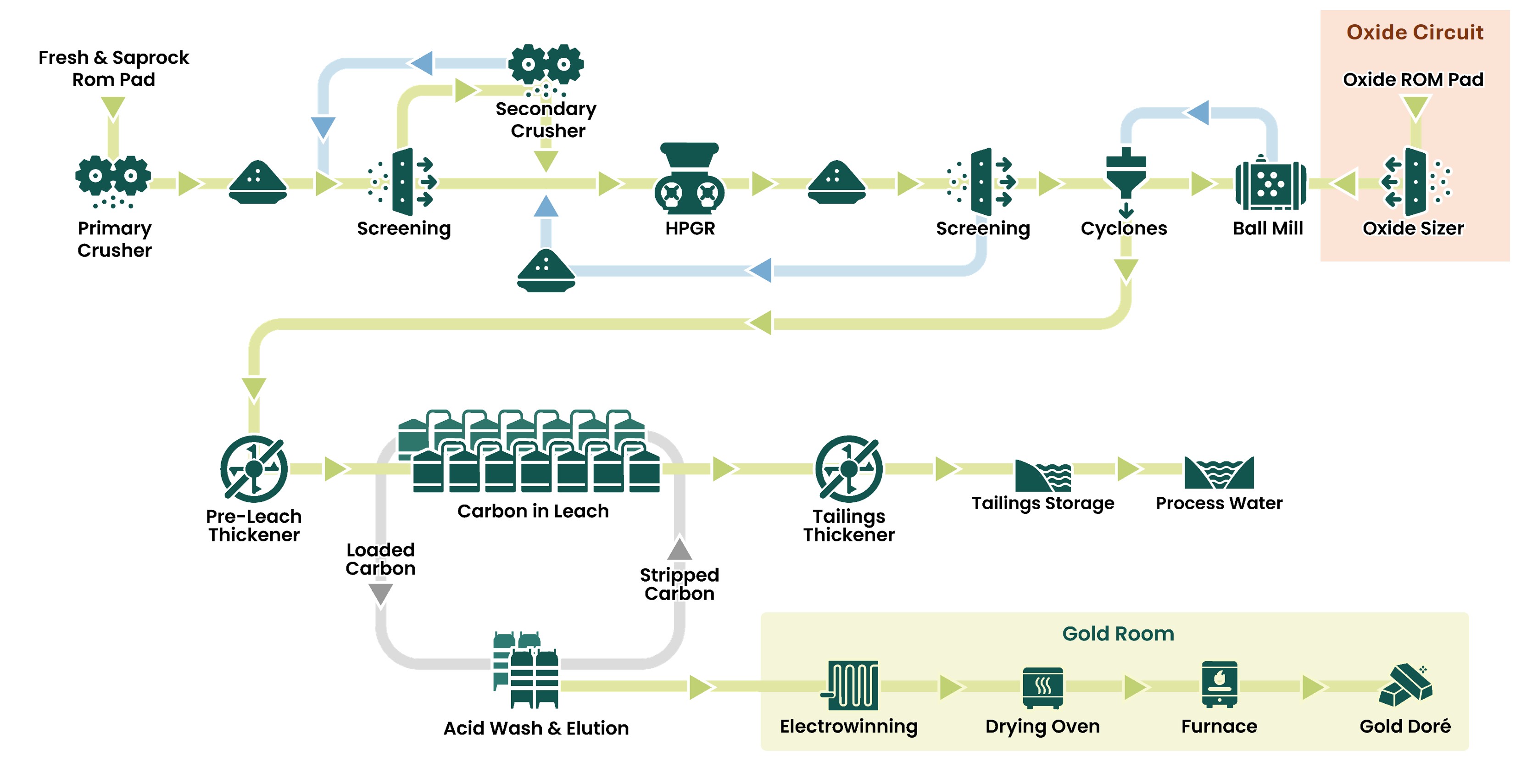

- Addition of an oxide circuit to allow processing of 100% oxide feed is expected to provide enhanced operational flexibility, improve plant availability and utilisation, lower oxide pre-stripping and rehandling requirements thereby reducing working capital outflows, and provide the potential to advance first gold pour and thereby reduce the peak upfront capital requirement.

-

Shift to an owner-operated mining model, with equipment financing, is expected to improve operating efficiencies, provide strategic mine planning flexibility to quickly integrate new satellite deposits into the mine plan concurrent to their discovery, and align with Montage’s commitment to developing local talent through training programmes as evidenced with more than 90% of construction tasks being self-performed.

Martino De Ciccio, Chief Executive Officer of Montage, commented: “We are very pleased with the rapid progress being made to unlock value at our Koné project in Côte d’Ivoire, which is tracking well on-schedule for first gold in Q2-2027 and on-budget. The Koné project already ranks as one of the largest gold projects currently under construction globally and continues to demonstrate optionality to further improve in quality. This is being achieved through a two-fold approach consisting of operational enhancements to add strategic flexibility while improving efficiencies, along with the execution of our goal of integrating higher-grade material from the onset by discovering higher-grade satellites and with advanced grade control drilling highlighting the potential to delineate higher-grade zones within the Koné and Gbongogo Main deposits.

Given our ambition of creating a premier African gold producer, we are very pleased to implement an owner-operated mining model, supported by equipment financing, as it is expected to improve operating efficiencies while providing strategic mine planning flexibility to quickly integrate new satellite deposits into the mine plan. Moreover, as mining is a key function within our business, we look forward to having full oversight while upholding Montage’s commitment to developing local talent through training programmes as evidenced with more than 90% of construction tasks being self-performed.

Our continued success builds on the momentum generated thus far to advance our strategy of creating a premier African Gold producer and delivering value for all our stakeholders.”

Peder Olsen, President and Chief Development Officer of Montage, commented: “Construction activities at our Koné project continue to progress at a rapid pace, with more than 4.5 million hours worked to date and a number of key milestones achieved several months early.

The erection of six CIL tanks, completion of the mill foundations, delivery of critical water supply infrastructure, and the near finalization of the resettlement village are key notable achievements. The delivery of the ball mill to site in Q1-2026 will mark the next significant milestone as we rapidly advance toward first gold pour. We have also commenced construction of the oxide circuit, which is expected to improve plant availability, reduce pre-strip volumes and rehandling requirements, and provide the potential to accelerate first gold production.

Together with the key design enhancements made last year, these initiatives provide opportunities to unlock significant value for all stakeholders as we continue to deliver on our construction schedule.”

Figure 1: Koné process plant overview

KONÉ PROJECT UPDATE

Construction activities at the Koné project continue to progress on-budget and well on-schedule for first gold pour in Q2-2027, with key highlights summarized below:

- On-site workforce now exceeds 2,800 employees and contractors, with over 4.5 million hours worked, and with over 90% local employment, demonstrating the Company’s commitment to local content with training programmes being conducted in partnership with the government-accredited Lycée Technique de Mankono across the following professions: steel fixing, building, electrical, masonry, carpentry, plumbing, firefighting, working at heights, environmental management, and heavy equipment operation.

-

Process plant construction continues to rapidly advance:

- CIL tank construction ongoing and tracking two months ahead of schedule with all concrete now poured and erection of six of the seven tanks on the first CIL train completed.

- Major mill foundations and concrete works are complete.

- The pre-leach and tails thickener concrete base pour has been completed, with final pedestal concrete pours on the tailings thickener ongoing.

- Reagent, cyanide and lime storage shed construction is progressing well, with steel-framing complete almost two months ahead of schedule and joint sealing of buildings currently ongoing.

- Elution train concrete pour for plinths and ramps has been completed, with earthworks preparation for circular plinths commencing. Piperack installation to and from the elution train has commenced two months ahead of schedule.

- Gold room rebar is complete on four ring beams, concrete pours on two rings beams is complete, while formwork is ongoing on the remaining two ring beams.

- Construction of process and site buildings has rapidly progressed, with the main admin building and clinic complete and being utilised by the construction team. Final construction works on the temporary workshop, CSR building, control room and training buildings is nearing completion.

Figure 2: Process plant key infrastructure

-

Construction of an oxide circuit has commenced following the completion of engineering with earthworks largely complete and the oxide run-of-mine (“ROM”) bin concrete pour well advanced. As demonstrated in Figure 3 below, the oxide circuit will consist of a sizer and conveyor to directly feed the mill with oxide and transitional material, bypassing the hard rock comminution and HPGR. The incremental upfront capital is approximately $25.0 million, which represents significant savings compared to constructing the circuit at a later stage, when in production, due to synergies across mobilisation, earthworks, concrete and civil works given ongoing construction activities. Given the recent discovery of higher-grade satellites with near-surface oxide material, the oxide circuit is expected to provide several significant operational, financial and strategic benefits, including:

- Optionality to bring forward the first gold pour and reduce peak funding as the Company is investigating the opportunity to commission the oxide circuit ahead of completing the hard rock comminution circuit, with further updates expected to be provided as construction progresses.

- Enhanced flexibility and efficiency including the ability to bypass the hard rock comminution circuit enabling oxide processing to continue during planned maintenance activities in the hard rock crushing circuit and improved mining and rehandling costs due to the reduced oxide material pre-stripping requirements at both the Koné and Gbongogo Main deposits, along with reduced oxide stockpiling requirements over the life-of-mine.

- Ability to integrate higher grade oxide discoveries into the mine plan at the onset of production given the attractive oxide content found near-surface in satellite deposits, rather than being constrained to the 10% maximum oxide feed required in the primary crushing circuit. The capacity of the process plant based on a full oxide feed is expected to remain the same as that of the hard rock comminution circuit at 11Mtpa, enabling the throughput to remain unchanged regardless of mill ore feed blend.

Figure 3: Koné processing plant flowsheet with oxide circuit

- Engineering, design, and procurement is well advanced and continues to progress alongside site construction works. Engineering for the oxide circuit has been completed supporting its construction decision.

- Fabrication of long-lead items such as the crushers, mill, thickeners, HPGR and structural steel are all progressing on schedule with pricing in line with or below budget. The ball mill is anticipated to arrive on site in Q1-2026, which will mark an important milestone.

Figure 4: Fabrication of key processing equipment and steel

-

Owner mining operating model adopted following a comprehensive review and competitive tender process of both owner-operated and contractor mining models. The owner-operated mining model is underpinned by a long-term contractual agreement with Neemba International Limited (“Neemba”), the Caterpillar dealership for 11 countries in West Africa, including Côte d’Ivoire, with fleet acquisition and mobilisation costs financed through a $75.0 million Equipment Finance Facility (as detailed in the section below). The owner-operated mining model is expected to provide greater mine planning flexibility, improve operating efficiencies, and aligns with Montage’s commitment to developing local talent through training programmes as evidenced with a number of tasks being self-performed during the construction phase. Furthermore, the owner-operated mining model is expected to enable the swift integration of higher-grade satellite deposits into the production schedule, with mine planning frequently optimized to incorporate new expected higher-grade discoveries.

Neemba will ensure the delivery of a series of high-quality machines that have been tested across various West African mining operations, ensuring high availability and reliability, supported by in-country distribution centres for spare parts. The equipment to be delivered is summarised in Table 1 below.

Table 1: Koné project owner mining fleet

| Quantity | Model |

| 6 | 6020 - 200t Dig Units |

| 40 | 777-05 - 90t Haul Trucks |

| 8 | D9 - 50t Dozer |

| 4 | 16 - 16ft Grader |

| 2 | 992 - 12m3 Wheel Loader |

| 4 | 777 – 70,000L Water Truck |

| 3 | 773 – 30,000L Fuel & Lube Truck |

-

Water supply infrastructure was completed following the commissioning of the river abstraction and booster stations in August 2025, alongside completion of welding of the high-density polyethylene pipes which has allowed for water to be pumped to the Water Storage Facility.

Figure 5: River abstraction site and pumping infrastructure

-

Water Storage Facility was completed ahead of the rainy season with accumulation of water on track and estimated to now hold over 1.5M cubic metres of water, out of a total capacity of 6.50M cubic meters.

Figure 6: Water storage facility

- Gbongogo haul road clearing has been completed between the Koné processing plant and the Marahoué river crossing. Culverts have been emplaced, with erosion protection ongoing across the length of the haul road. The remaining haul road north of the Marahoué river is scheduled to commence in Q4-2025, after the rainy season.

- Grid connection civil works are ongoing on the 225kV to 33kV reticulation with transformer walls and exterior block wall construction also ongoing. Excavation of the footings of 17 towers for the 225kV power line have been completed, with concrete and stub settings now complete on 11 of the towers. Underground conduits for high voltage electrical cables are well advanced, connecting key processing and administrative buildings, while pole installations for the 33kV overhead line to key infrastructure sites are also well progressed.

Figure 7: Electrical substation and high-voltage grid connection preparation

- Airstrip construction is largely complete with permitter fencing now being installed. Permanent riprap placement in the permitter drains is ongoing. The airstrip is expected to be fully operational with all required permits in place by early 2026.

- Tailings Storage Facility (“TSF”) earthworks continue to progress approximately 3 months ahead of schedule with bush clearing, topsoil stripping and stacking taking place. The TSF liner has arrived on site with installation scheduled to begin in Q4-2025, after the rainy season.

Figure 8: TSF clearing and airstrip

-

The permanent camp construction is advancing well with accommodation capacity currently amounting to in excess of 300 rooms. A further 50 permanent rooms are undergoing internal decorating alongside the construction of senior-level accommodation. Camp facilities including the permanent restaurant, laundry house and gym are expected to be operational in the coming weeks.

Figure 9: Permanent camp construction

-

Resettlement village construction is now over 95% complete and tracking over two months ahead of schedule, with 109 newly-built homes in the final stages of construction. Final preparations for the formal handover of homes to affected families is ongoing, with the first families expected to inhabit the newly constructed village in the coming weeks. Further progress continues to be made on construction of the village school and on places of worship, as well as clinics, a market and a community centre.

Figure 10: Resettlement village construction

MINING EQUIPMENT FINANCING

The Company has entered into a $75.0 million equipment financing facility agreement (the “Equipment Finance Facility”) with CAT Financial that will cover additional capital expenditure associated with the delivery, provision of vendor-managed parts, comprehensive product support, and training services for the full fleet of equipment units. The owner fleet will include haul trucks, excavators, and ancillary support equipment, with continuous deliveries scheduled to begin in mid-2026.

Under the terms of the Equipment Finance Facility, CAT Financial will enable Montage to purchase the mining fleet via a five-year term loan secured by the equipment itself, as outlined below:

- Facility amount: $75.0 million with an availability period ending on the earlier of (i) being fully drawn under the Equipment Finance Facility and (ii) June 30, 2027.

- Use of proceeds: Proceeds to be used to fund 85% of the purchase price of the mining fleet, vendor-managed spare parts, comprehensive product support, and training services for the full fleet. The remaining 15% of funding was already provisioned within the previously published upfront capital requirement of $835.0 million as contractor mobilisation costs, and therefore the total upfront capital requirement remains unchanged compared to the previous contract mining assumptions.

- Interest rate: 3-month CME Term Secured Overnight Financing Rate plus 3.45% per annum.

-

Maturity and repayment: Repaid through amortisation repayments across 20 equal quarterly instalments commencing after expiry of the availability period.

TIMELINE TO FIRST GOLD POUR

The Company remains on-budget and well on-schedule for first gold pour in Q2-2027 alongside the potential to bring forward first gold production by commissioning the oxide circuit ahead of hard rock comminution circuit, with further updates expected to be provided as construction progresses. The timeline to first gold pour, on the hard rock comminution circuit, is based on a 27-month construction period, with key upcoming milestones presented in Table 2 below.

Table 2: Koné project timeline to first gold pour

| Work Stream | Q1-2025 | Q2-2025 | Q3-2025 | Q4-2025 | Q1-2026 | Q2-2026 | Q3-2026 | Q4-2026 | Q1-2027 | Q2-2027 |

| Tailings Dam & Water Dams | ||||||||||

| Tailings Dam | * | * | * | |||||||

| Water Storage & Dam | * | * | ||||||||

| Construction | ||||||||||

| Power Supply | * | * | * | * | * | |||||

| Site Infrastructure | * | * | * | * | * | * | * | |||

| Earth works & Concrete Works | * | * | * | * | * | * | ||||

| Structural, Mechanical, Piping | * | * | * | * | * | * | ||||

| Electrical | * | * | * | * | ||||||

| Process Plant Commissioning | * | * | * | |||||||

| First Gold | * |

Based on the addition of an oxide circuit, the total capital expenditure for the project now stands at $860 million, up from $835 million, while the optionality to bring forward the first gold pour, by first commissioning the oxide circuit ahead of completing the hard rock comminution circuit, may reduce peak upfront capital requirements. A total of approximately $418.3 million of capital had been committed to date, representing approximately half of the total capital expenditure, with prices in line with expectations.

EXPLORATION ACTIVITIES

Montage remains on track to achieve its short-term exploration target, as published on October 7, 2024, of discovering more than 1Moz of Measured and Indicated Resources, at a grade 50% higher than the Koné deposit, to be achieved before the commencement of production1. Achieving the set exploration target would represent a significant return on the exploration investment and aligns with the Company’s strategic objective of improving the production profile from the onset, thereby maintaining an annual production of at least 300koz for more than 10 years. Indicated Resources for satellite deposits have already grown by 404koz to 924koz at 1.32 g/t Au with an additional 140koz at 1.09 g/t Au of Inferred Resources.

The Company’s expanded 2025 exploration programme, which includes 120,000 meters of exploration drilling (up from 90,000 meters), continues to focus on delineating higher-grade satellite resources, with step-out and in-fill drilling continuing at all 7 new higher-grade satellite deposits for which starter maiden resources were published in early 2025, including Koban North, Gbongogo South and ANV. Exploration also continues to progress on the 6 targets which were advanced to pre-resource stage last year including Soman 1 & 2 and Petit Yao, with the goal of delineating starter resources to access the grade profiles in order to prioritize upcoming drill efforts, in addition to testing new targets. In total, approximately 85,800 meters have been drilled since the start of the year across 23 targets, with mineralisation confirmed at all targets.

Additionally, the pre-production drilling programme of approximately 56,000 meters, launched earlier this year, has now concluded. Preliminary assay results received to date have confirmed both the grade and continuity of the mineralized envelopes, while also highlighting the potential to delineate higher-grade zones within the Koné and Gbongogo Main deposits. Full results of the pre-production drilling programme will be integrated into the resource block model and published in late 2025.

ABOUT MONTAGE GOLD

Montage Gold Corp. (TSX: MAU) is a Canadian-listed company focused on becoming a premier African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Updated Feasibility Study published in 2024 (the “UFS”), the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years and is expected to enter production in Q2-2027.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release have been verified and approved by Mr. Peder Olsen, a Qualified Person pursuant to NI 43-101. Mr. Olsen, President and Chief Development Officer of Montage, is a registered Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM).

|

CONTACT INFORMATION For Investor Relations Inquiries: Jake Cain Strategy & Investor Relations Manager jcain@montagegold.com +44-7788-687-567 |

For Media Inquiries: John Vincic Oakstrom Advisors john@oakstrom.com +1-647-402-6375 |

For Regulatory Inquiries: Kathy Love Corporate Secretary klove@montagegold.com +1-604-512-2959 |

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the Company’s objectives of achieving first gold pour in the second quarter of 2027 and the optionality to accelerate that schedule; the Company’s mineral reserve and resource estimates; results of the drill programs including targeted additions to the estimated mineral resources at the Koné project, and the timing thereof; results of the advanced grade control drill programme; expected recoveries and grades of the Koné project; timing in respect of the commencement and completion of construction of various components of the Koné project, the length of construction and of the mining operations at the Koné project, including estimated construction costs; timing and amount of necessary financing related to the mining operations at the Koné Gold project; the timing and amount of future production from the Koné project; anticipated mining and processing methods of the Koné project; anticipated mine life of the Koné project; anticipated economic and, operational and strategic benefits of the adoption of an owner-mining strategy. Including lower mining costs, working capital improvements and rapid incorporation of new deposits; anticipated operational efficiencies and flexibility and other benefits of the construction of the oxide circuit; and the publication of a new resource estimate in 2025.

Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that any Forward-looking Statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements, including that the returns from the Koné project will be lower than estimated, that targeted additions to the mineral resources will not be achieved or that additional resources will not be benefit the Kone project due to lower grades or higher costs than anticipated, that the cost of construction of the Koné project will be higher than estimated, or that the Company will not be able to achieve lower mining costs than under contractor mining. Important factors that could cause actual results to differ materially from include uncertainties inherent in the preparation of mineral reserve and resource estimates and definitive feasibility studies, and in delineating new mineral reserve and resource estimates, including but not limited to, assumptions underlying the production estimates not being realized, incorrect cost assumptions, decreases in the price of gold, unexpected variations in quantity of mineralized material, grade or recovery rates being lower than expected, unexpected adverse changes to geotechnical or hydrogeological considerations, or expectations in that regard not being met, unexpected failures of plant, equipment or processes (including construction equipment), delays in or increased costs for the delivery of construction equipment and services, unexpected changes to availability of power or the power rates, failure to maintain permits and licenses, higher than expected interest or tax rates, labour stoppages, failure to adequately train staff, incorrect assessment of equipment needs, adverse changes in project parameters, unanticipated delays and costs of consulting and accommodating rights of local communities, environmental risks inherent in the Côte d’Ivoire, title risks, including failure to renew concessions, unanticipated commodity price and exchange rate fluctuations, delays in or failure to receive access agreements or amended permits, and other risk factors set forth in the Company’s Annual Information Form available at www.sedarplus.ca, under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

___________________________________

1 For further information on the discovery target please refer to the Company’s news release dated October 7, 2024, and for information regarding the Koné deposit please refer to the Updated Feasibility Study available on Montage’s website and on SEDAR+.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca6fc491-c86b-4632-b922-8d9a5def9b80

https://www.globenewswire.com/NewsRoom/AttachmentNg/19e93fe9-e945-4aa5-bc27-6a919e1b685e

https://www.globenewswire.com/NewsRoom/AttachmentNg/da31570e-7e51-40c2-8286-5e6c6eb5cce1

https://www.globenewswire.com/NewsRoom/AttachmentNg/578802d4-b0e9-4d40-a977-0106265f408c

https://www.globenewswire.com/NewsRoom/AttachmentNg/ffcd7cf8-3a5c-4bbc-a6aa-84bb931439ad

https://www.globenewswire.com/NewsRoom/AttachmentNg/bab7f098-8e21-4a39-9bd9-9f93e8947ec2

https://www.globenewswire.com/NewsRoom/AttachmentNg/525e18e2-c960-465b-ae1e-503b09cd1591

https://www.globenewswire.com/NewsRoom/AttachmentNg/ccae6c6d-04ce-41b7-9506-23605a2666ea

https://www.globenewswire.com/NewsRoom/AttachmentNg/e68c1c95-8694-4c8e-a332-894f69505f98

https://www.globenewswire.com/NewsRoom/AttachmentNg/7e1613ff-cb4f-44ae-a7c7-6d2ec4fcdbe2

Figure 1

Koné process plant overview

Figure 4

Fabrication of key processing equipment and steel

Figure 5

River abstraction site and pumping infrastructure

Figure 3

Koné processing plant flowsheet with oxide circuit

Figure 6

Water storage facility

Figure 2

Process plant key infrastructure

Figure 7

Electrical substation and high-voltage grid connection preparation

Figure 9

Permanent camp construction

Figure 10

Resettlement village construction

Figure 8

TSF clearing and airstrip

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.